The Grieving Families Act (the “Act”), which the New York State Legislature passed on the final day of the June 2022 legislative session, was vetoed by Governor Hochul last night, as the Act formally expired. This followed an op-ed she published yesterday supporting the amendment of the wrongful death statute to expand recovery, particularly for the families of deceased children.

The Act expanded the types of damages recoverable in wrongful death suits, where recovery is presently limited to “pecuniary losses” of a decedent’s distributees, which is generally limited to a decedent’s future lost earnings. Although case law allows recovery of pecuniary loss in the form of a decedent’s pre-death conscious pain and suffering and for loss of parental support, guidance, assistance and inheritance, these damages are often difficult to prove. The Act sought to 1) permit a decedent’s survivors (vaguely defined as “close family members”) to recover for their own “emotional anguish” or pain and suffering; 2) extend the applicable statute of limitations from 2 to 3.5 years; and 3) take immediate, retroactive effect in all pending wrongful death suits.

In vetoing the Act, Governor Hochul voiced her support for the proposed expansion of the existing statute, citing the inequity against the families of minors and others in valuing a life based solely on its future earning potential. However, she cited the following concerns with the scope, financial impact and other “significant unintended consequences” of the Act, as drafted:

- The indefinite expansion of the beneficiary class will pose difficult questions regarding “closeness,” and protracted discovery and increased litigation costs, particularly in pending cases in which new potential claimants will seek to interject themselves; and

- The increase in already-high health and other insurance costs, particularly on lower-income families, small businesses, and health care workers and hospitals, which are still struggling from pandemic-related financial pressures.

The Governor called for serious evaluation and study of the financial impact of these expansive changes on these groups particularly, and on the New York State economy generally. Most significantly, she agreed with opponents of the Act that have argued that the State’s constitutional prohibition against limits on jury verdicts on damages must be studied and considered. This refers to the fact that although almost every other state allows for some or many of the expanded classes of beneficiaries or types of damage claims the Act sought to add, but each of those states also have laws capping verdicts on such damages, which New York does not.

The Governor’s veto indicates that the drive to significantly expand the scope of the wrongful death statute is only temporarily defeated, that she is sympathetic and in favor of its expansion, but that she will only sign a bill that considers the overall impact to the general economy.

Should you have any questions, please do not hesitate to contact Howard Klar or William Parra.

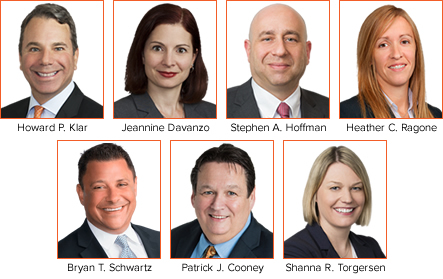

Gallo Vitucci Klar LLP is proud to announce that 12 of our Partners and Associates have been named to the Super Lawyers and Rising Stars list for the year 2022. These GVK recipients have been recognized as the top attorneys in the New York Metro area for 2022. No more than 2.5 percent of lawyers in the state are selected per year to the Super Lawyers or Rising Stars listings, yet many of our attorneys have been named to the list year after year. Approximately 20% of our attorneys have received this recognition this year.

2022 Rising Stars

The GVK 2022 Rising Stars include, Partner, Jessica Clark who was selected to the Rising Stars list for her tenth consecutive year for her excellence in construction and general litigation. Partner, Brandon Weinstein was selected to the Rising Star list for his second consecutive year for his excellence in civil litigation and personal injury. Partner, Ancilla Dias-Pinto was selected to the Rising Star list for her second consecutive year for her excellence in personal injury.

2022 Super Lawyers

In addition to these three Rising Stars, Senior Partners; Howard P. Klar, Matthew J. Vitucci and Partners; Jeannine Davanzo, Stephen A. Hoffman, Heather C. Ragone, Bryan T. Schwartz, Patrick J. Cooney, Joe J. Rava, and Shanna R. Torgersen have been named to the 2022 New York Metro Super Lawyers List.

Senior Partner, Howard P. Klar has been named to New York Metro Super Lawyer List for his eleventh consecutive year in civil litigation defense. Senior Partner, Matthew J. Vitucci has been named to New York Metro Super Lawyer List for his tenth consecutive year in Civil litigation and Personal injury defense.

Partner, Patrick J. Cooney was selected for his second consecutive year in personal injury, civil litigation, construction litigation, insurance coverage, personal injury and transportation/maritime defense. Partner, Jeannine Davanzo was selected to the listing for her seventh consecutive year for her excellence in personal injury and construction litigation. Partner, Stephen A. Hoffman was selected for his seventh consecutive year in civil litigation defense. Partner, Heather C. Ragone was selected for her seventh consecutive year in transportation/maritime and insurance coverage defense. Partner, Bryan T. Schwartz was selected for his second consecutive year in personal injury defense. Partner, Joe J. Rava was selected for his second consecutive year in personal injury, appellate and insurance coverage defense. Partner, Shanna R. Torgersen was selected for her second consecutive year in professional liability, civil litigation, personal injury/general, personal injury/products and construction litigation defense.

Over the past few months GVK has added a number of attorneys across all experience levels to the firm in our various practice groups. The addition of these attorneys furthers our ability to provide to our clients the highest level of legal services in our industry. GVK is pleased to welcome Amanda Aiello, James Burbage, Debora Dillon, Scott Eisenberg, Matthew Finegan, Nadine Ibrahim, Michael Liloia, Tom Muldoon, Daniel Nachman, Paul Pastore, David Roemer, Isaac Rosen, Dennis Swanson, John Szewczuk, Rachel Trauner and Sebastian Vollkommer to the firm.

ATTORNEYS

Amanda Aiello joins GVK as an Associate. Amanda has over six years’ of experience litigating complex matters and more than four years of civil tort litigation including premises liability, constriction litigation, labor law claims, and general liability matters. Amanda works out of the Woodbury, NY office.

James Burbage joins GVK as a Partner. James has over 30 years’ experience handling, negligence claims encompassing: auto, trucking, slip and trip and falls, Labor Law, subrogation, property damage, coverage, and public entities. James works out of the Irvington, NY office.

Debora Dillon joins GVK as Of Counsel. Debora has over 29 years’ experience, handling predominantly premises liability and vehicular/transportation liability matters. Debora works out of the Irvington, NY office.

Scott Eisenberg joins GVK as an Associate. Scott has over 16 years’ experience handling premises liability, motor vehicle accidents, negligent security, property damage, New York Labor Law 240/241, and DRAM Shop cases. Scott works out of the Woodbury, NY office.

Nadine Ibrahim joins GVK as an Associate. Nadine has over six years’ experience handling both criminal matters and civil liability defense. Nadine works out of the Hackensack, NJ office.

Michael J. Liloia joins GVK as an Associate. Michael has over 14 years’ experience handling general liability and personal injury litigation. Michael works out of the Hackensack, NJ office.

Tom Muldoon joins GVK as a Partner. Tom has over 25 years’ experience in multiple jurisdictions focused on defending construction site accidents, premises liability claims, catastrophic injury claims, automotive liability claims, insurance coverage and contractual claims. Tom works out of the Irvington, NY office.

Daniel Nachman joins GVK as an Associate. Daniel formerly served as a judicial law clerk to the Honorable Mary F. Thurber in the New Jersey Superior Court. Daniel works out of the Hackensack, NJ office.

David Roemer joins GVK as an Associate. Daniel has over 15 years’ experience handling New York Labor Law, premises liability and commercial automobile claims. David works out of the Hackensack, NJ office.

Isaac Rosen joins GVK as an Associate. Isaac has over three of years’ experience handling personal injury, premise liability, product liability, labor law, construction law, insurance defense, elevator/escalator, and workers’ compensation law. Isaac works out of the Hackensack, NJ office.

John Szewczuk joins GVK as an Associate. John has over 40 years’ of experience in trying general negligence cases including labor law/construction, sidewalk, lead paint, premises liability including trip and falls, building fires, and motor vehicle accidents. John works out of the 90 Broad Street, NY office.

Rachel Trauner joins GVK as Of Counsel. Rachel has over ten years’ experience handling complex, construction accident, construction defect, premises liability, and automobile liability claims. Rachel works out of the 90 Broad Street, NY office.

FIRST YEARS

Matthew Finnegan joins GVK as an Associate. Matt graduated in May of 2022 from St. John’s University School of Law. He has passed the New York State Bar Examination and is currently awaiting admission to the New York State Bar. Matthew works out of the Woodbury, NY office.

Sebastian Vollkommer joins GVK as an Associate. Sebastian graduated in May of 2022 from St. John’s University School of Law. He has passed the New York State Bar Examination and is currently awaiting admission to the New York State Bar. Sebastian works out of the 90 Broad Street, NY office.

Dennis Swanson joins GVK as an Associate. Dennis graduated in 2021 from the Maurice A. Deane School of Law at Hofstra University. He has passed the New York State Bar Examination and is currently awaiting admission to the New York State Bar. Dennis works out of the 90 Broad Street, NY office.

Paul Pastore joins GVK as an associate. Paul graduated in May from St. John’s law. He has passed the New York State Bar Examination and is currently awaiting admission to the New York State Bar. Paul works out of the 90 Broad Street, NY office.

Matthew Finegan, Daniel Nachman, Paul Pastore and Sebastian Vollkommer have each passed the NY State Bar exam and will be admitted to practice in the coming months!

Matthew J. Vitucci obtained a defense verdict on a damages only trial where plaintiff sought over $3,000,000.00 from the jury. Plaintiff, Maribel Ortega aged 56, alleged she was stopped in traffic eastbound on McLean Avenue and within its intersection with the southbound portion of Central Park Avenue in Yonkers, New York when our client’s tractor trailer made a wide left turn from the right westbound lane to go south on Central Park Avenue and struck the plaintiff’s 2015 Honda SUV on the driver’s side. Our client admitted liability in causing the subject accident; therefore, the case proceeded to trial on the issue of damages only.

Plaintiff claimed to have sustained severe injuries as a result of the collision. Following a yearlong course of conservative care Plaintiff underwent an anterior discectomy and fusion at level C5-C6 of her cervical spine. Plaintiff claimed severe aftereffects following the surgery including an allegation that there was a lack of fusion of the bone graft in the spine leading to a catastrophic hardware failure which would require the removal of the fusion construct, and re-implantation of new hardware. Plaintiff produced experts who opined that she would also require a Lumbar discectomy and fusion, a total knee replacement for her right knee, and a left shoulder surgery. Plaintiff produced evidence at trial through a life care plan that her future medical care needs for allegedly necessary medical care totaled $2.7 million dollars.

In defense to the injury claims we offered the testimony of a neurosurgeon who that plaintiff merely suffered from the continued deterioration of a cervical disc that had been injured in a prior accident. The expert further opined that the hardware construct was stable and not in need of repair. He disputed that plaintiff had pathology in her lumbosacral spine that required treatment. He further saw no need for future care.

We produced the testimony of an Orthopedic surgeon who opined that plaintiff suffered from preexisting arthritic changes in her knee and shoulder and that imaging showed no traumatic cause for plaintiff’s complaints.

Upon the close of evidence plaintiff requested in summation that the jury give an award of over three million dollars. Following five hours of deliberation the jury issued a verdict in favor of the defense find that plaintiff failed to prove that that she sustained a serious injury from the accident pursuant to the New York State Insurance Law.

Our investigation into plaintiff’s prior accident history revealed that she sustained injuries to the same body parts allegedly injured in the subject accident. At the time of trial, we offered evidence which identified plaintiff’s prior medical treatment and complaints of residual pain which lasted for years after the prior accidents.

Despite our client’s admission of liability in causing the collision, we argued that the subject incident was nothing more than a “side-swipe” accident which did not cause the plaintiff to sustain a permanent serious injury within the meaning of New York Insurance Law §5102(d). In support of our position, we offered full testimony of a biomedical engineer who opined that the nature of the contact imparted an insubstantial force to cause injury.

GVK congratulates our Partner, Joseph Scarglato, for being appointed by the Brooklyn Bar Association to Vice Chair of both the Transportation Law Committee and Tort Law Committee. In his leadership role, Joseph will coordinate CLE programs and Association publications related to transportation and tort law.

Plaintiff, a nurse working in a Dutchess County Hospital specimen room, was struck on the head by a 90 lb. overhead cabinet which suddenly detached from the wall.

Investigation disclosed that the cabinet was installed 8 months earlier, as part of a hospital expansion project involving construction of a new services wing. It was concluded that our client, a metal frame and sheetrock contractor, failed to install necessary wood backing for the cabinet installation per architect specifications, and that the cabinet in question was improperly attached to the wall by screwing it into the metal studs. Plaintiff brought suit against the cabinet maker, the general contractor who allegedly approved the alternate method for attaching the cabinet to the wall, the cabinet installer, the metal framer (our client) who concededly omitted the wood blocking, and the architect who was present and impliedly concurred with the cabinet’s revised installation method.

Plaintiff was granted summary judgment and the case was directed to proceed as a liability apportionment trial.

We argued that the missing wood blocking was an expected occurrence on a job of this scope and nature, and that our client’s liability should be cut off by actions of the cabinet installer who was indisputably aware of the blocking omission at the time of the installation, along with other parties who approved the revised cabinet installation procedure. The jury agreed with our assessment and awarded our client a Defense Verdict, holding the cabinet installer, general contractor, and architect, responsible for the occurrence in varying percentages.

By William Parra and Thomas Vitucci

On Jun. 3, 2022, both houses of the New York State Legislature passed the Grieving Families Act (S74A/A6770) (the “Act”), during its final session. The legislation proposes to amend Estates, Powers and Trusts Law (“EPTL”) §§ 5-4.1, 4.3, 4.4 and 4.6 to expand the types of damages recoverable in wrongful death suits. New York law presently limits recovery in wrongful death suits to “pecuniary losses” of a decedent’s distributees, generally calculated by the decedent’s future lost earnings. Existing precedent also allows for the recovery of a decedent’s pre-death conscious pain and suffering and loss of support, parental guidance and assistance and inheritance as types of pecuniary loss, although these other damages are often difficult to prove.

The Act’s most significant change allows a decedent’s survivors to recover for their own “emotional anguish” or pain and suffering. It further changes existing law, as follows:

- extends the applicable wrongful death statute of limitations from 2 to 3.5 years;

- expands who can recover to “close family members;” and

- takes effect immediately and retroactively in all existing and future wrongful death suits.

The Act will conform New York law with that in the majority (41) of states. The question is whether this is the right time to enact this change and whether Governor Hocul will sign it. On the first question, the COVID 19 pandemic created unprecedented financial struggles for New York businesses, particularly small businesses, the impact of which continues. Countless businesses failed and those that survived continue to struggle financially. Amending existing law to allow for a new category of damages by an expanded group of beneficiaries, i.e., “close family members,” will greatly expand business owners’ financial exposure and raise insurance costs in a City and State where the cost of doing business is already prohibitively high. For instance, the Act expands standing to bring a wrongful death suit to any “close family member,” including but not limited to spouses, domestic partners, grandparents, step-parents, siblings and children, “based upon the specific circumstances relating to the person’s relationship with the decedent.” Such an expansion of damages in existing actions will be particularly prejudicial to defendants in terms of their expectation of and actual financial exposure.

Whether the Governor will sign the Act into law within the required 10-day period is another question. The rash of bills the Legislature passed in its final session may best be explained as an effort by legislators to show they are working for their constituents’ best interests in an election year. How many of these bills the Governor can and will review for signing within the 10-day period, and whether this Act will be one of them, remains to be seen. Otherwise, it will not go into effect and will need to be voted on and passed again, in the next Legislative session.

Should you have any questions concerning the impact of these amendments, please do not hesitate to contact Howard Klar or William Parra.

Governor Hochul signed the amendments to the NY Comprehensive Insurance Disclosure Act (“CIDA”) into law today. The following constitutes the relevant insurance disclosure requirements in NY State, under the revised law. The CIDA now applies only to cases in which Defendants filed an answer on/after Dec. 31, 2021. It no longer applies retroactively to existing cases. It does not apply pre-suit. In new cases, the CIDA requires every defendant to disclose the following, within 90 days of each defendant’s filing of its answer:

- Pursuant to CPLR §3101(f)(1), (f)(1)(i) and (f)(3), all defendants, third-party, cross-claim or counter-claim defendants, must disclose complete copies of any policy (primary or excess) or similar agreement (SIRs, captives, etc.) that “may” satisfy any part of a judgment or indemnify or reimburse payments to do same.

- Pursuant to CPLR §3101(f)(1)(iii), claims adjuster’s name and e-mail;

- Pursuant to CPLR §3101(f)(1)(iii), the total available policy limits, including any depletion, erosion or offsets to each disclosed policy’s limits; and

- Pursuant to CPLR §3101(f)(2) and CPLR §3122-b, defendants and their attorneys are each separately required to provide a certification accompanying the disclosure of the aforementioned information that they each made “reasonable efforts to ensure” this information remains “accurate and complete.”

After the initial disclosure, defendants are obligated to re-certify and update the aforementioned disclosure upon the filing of the Note of Issue and before any mediation, settlement conference or trial date(s), and for 60 days after any settlement, entry of final judgment or appeal.

The most significant changes are that the CIDA no longer applies retroactively to existing cases (which were due Mar. 1st) and that policy applications are no longer required to be disclosed.

Should you have any questions concerning the CIDA’s requirements, please do not hesitate to contact Howard Klar or William Parra.

On Jan. 18, 2022, a bill to amend the recently enacted Comprehensive Insurance Disclosure Act (“CIDA”) was introduced in the NYS Senate. The proposed changes in Bill S07882 are virtually identical to those Governor Hochul proposed, which were outlined in our Jan. 6th alert. As you may recall, the Governor qualified her signing of the bill by issuing a “signing memo” stating that she did so after coming to an agreement with the Legislature to “properly tailor” the CIDA for its intended purpose, i.e., ensuring litigants were adequately notified of insurance coverage limits.

The most significant proposed changes to the CIDA include:

- Eliminating its retroactive effect, limiting its application to actions filed after 12.31.21;

- Eliminating the requirement to disclose policy applications;

- Increasing the compliance deadline in new actions from 60 to 90 days;

- Eliminating the obligation to disclose policies and suit/attorney/adjuster information in other actions that may erode the policy limits (disclosure of your adjuster’s information in your action would be limited to their name and email address);

- The “ongoing obligation” to ensure accuracy of disclosures would be modified to “must make reasonable efforts” to ensure the information remains accurate and complete (after initial disclosure) at the Note of Issue filing, before any mediation or trial, and for 60 days after settlement, final judgment or appeal; and

- Eliminating the requirement to disclose attorneys and attorneys’ fees that erode policy limits and the CIDA’s application to MVA PIP lawsuits.

It is our understanding that passage of the Bill could take at least several weeks. Therefore, while it appears possible that the proposed amendments will be enacted into law by or very close to the CIDA’s present Mar. 1st compliance deadline for existing cases, we must stress that its significant requirements (also outlined in our Jan. 6th alert) remain the law until that time.

We will continue to monitor and keep you updated as to the Bill’s progress.