Gallo Vitucci Klar LLP is pleased to announce that 16 of our Partners and Associates have been named to the Super Lawyers and Rising Stars list for the year 2021. These recipients have been recognized as the top attorneys in the New York Metro area and New Jersey for 2021. No more than 2.5 percent of lawyers in the state are selected per year to the Super Lawyers or Rising Stars listings, yet many of our attorneys have been named to the list year after year.

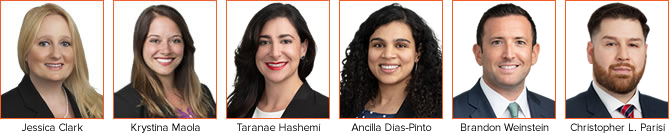

2021 New York Metro Rising Stars

- Jessica A. Clark – General Litigation

- Ancilla H. Dias-Pinto -Personal Injury Defense

- Taranae J. Hashemi – Civil Litigation Defense

- Krystina R. Maola – Personal Injury Defense

- Brandon H. Weinstein – Civil Litigation Defense

2021 New Jersey Rising Star

- Christopher L. Parisi – Construction Litigation

2021 New York Metro Super Lawyers

- Matthew J. Vitucci – Civil Litigation

- Howard P. Klar – Civil Litigation

- Kenneth S. Merber – Construction Litigation

- Stephen A. Hoffman – Civil Litigation

- Patrick J. Cooney – Personal Injury Defense

- Bryan T. Schwartz – Personal Injury Defense

- Joseph J. Rava – Personal Injury Defense

- Jeannine Davanzo – Products Liability Defense

- Heather C. Ragone – Transportation/Maritime Defense

- Shanna R. Torgerson – Professional Liability Defense

The annual Super Lawyer selections are made using a patented multiphase process that includes a statewide survey of lawyers, an independent research evaluation of candidates and peer reviews by practice area. The result is a credible, comprehensive and diverse listing of exceptional attorneys.

Commentary by Ryan J. Gerspach

On April 13, 2021, New York’s Appellate Division, First Department awarded a plaintiff $20 million for past and future pain and suffering in what is believed to be the highest such award in the State’s history. Perez v. Live Nation Worldwide, 2021 N.Y. Slip Op. 02259 (1st Dep’t 2021). The four-justice panel reduced the trial court’s award of $40.6 million, which itself reduced the jury’s $85.75 million award. However, despite ultimately reducing the jury’s pain and suffering award by more than 75%, the intermediate appellate court raised the bar for such awards. The court also affirmed the jury’s award of $13.5 million for past and future medical expenses and lost wages.

Plaintiff Mark Perez was 30 years old when he was severely injured at the Jones Beach Theater while erecting signage for an upcoming concert. Perez was working on an elevated structure when a stagehand hired by Live Nation drove a forklift into the structure, causing Perez to fall to the ground below. Perez sustained a subdural hematoma, multiple skull, facial and spinal fractures, seven broken ribs, multiple hemorrhages, and a punctured and collapsed lung. Perez was airlifted to a Nassau County trauma center where he underwent emergency surgery. Put into a medically induced coma, Perez spent nearly one month on life support, intubated, reliant on a feeding tube and chest tube. Several months of inpatient occupational, recreational, and neuropsychological therapy followed, as did three more neurosurgeries.

As noted by the First Department in its opinion, Perez’s traumatic brain injury resulted in encephalomalacia, cerebral atrophy, traumatic epilepsy, chronic pain and headaches, significant cognitive defects in attention, processing speed, memory, visual perception, intellectual function and executive functions, depression, anxiety, symptoms of post-traumatic stress, and increased risk of future neurological disease. Perez is expected to undergo at least one more neurological surgery in the near future.

Although the First Department found that the trial judge’s award of $40.6 million deviated materially from what was reasonable, it nonetheless raised the ceiling of recovery for past and future pain and suffering. In its decision, the court stressed the permanent nature of Perez’s neurological injuries in determining that $15 million was a reasonable sum for future pain and suffering. The court found that $5 million was a reasonable award for Perez’s past pain and suffering, endured since his accident in 2013.

The court was willing to award such figures despite, just three months ago, awarding another traumatic brain injury plaintiff $10 million for future pain and suffering. Hedges v. Planned Security Service, Inc., 190 A.D.3d 485 (1st Dep’t 2021). In so doing, the First Department demonstrated its willingness to raise the bar of sustainable pain and suffering verdicts for plaintiffs that suffer exceptionally severe traumatic brain injuries.

On March 24, 2021, GVK obtained dismissal of plaintiffs’ complaint asserting causes of action for legal malpractice, breach of contract and a violation of Judiciary Law § 487 against GVK’s attorney client. Plaintiffs alleged that they would have obtained a more favorable outcome in an underlying foreclosure action had GVK’s client asserted a statute of limitations defense in the foreclosure action. It was Plaintiffs position that the legal malpractice claim was not premature because the entry of a Judgment of Foreclosure and Sale was “final” and disposed of the case.

GVK successfully argued that plaintiffs could not meet the “case within-a-case” standard based on the fact that the foreclosure sale had not yet occurred, and thus there were no actual ascertainable damages. In addition, there was still an open Order to Show Cause filed on behalf of plaintiffs seeking to vacate the Judgement of Foreclosure and

Sale, which could render all or at least some of the malpractice claims moot.

Justice Porzio, in Supreme Court, Richmond County rejected plaintiffs’ arguments and agreed that the elements of causation and damages in Plaintiffs’ legal malpractice cause of action are dependent on the outcome of the Order to Show Cause, and as such, dismissed the malpractice cause of action as premature. The court also agreed that GVK demonstrated the breach of contract and violation of Judiciary Law § 487 claims were duplicative of the malpractice claims and not adequately plead and dismissed both causes of action.

Parenthetically, while plaintiff was granted leave to replead the malpractice claim, the ultimate success of such claim is now far less likely due to the recent New York Court of Appeals holding in Freedom Mortgage Corp. v. Engel which reversed the Second Department’s decision and held that acceleration of a mortgage loan may be revoked by the voluntary discontinuance of a prior foreclosure action. This holding, which came down while the motion practice was pending, renders it far less likely that a meritorious statute of limitations defense to the foreclosure action ever existed.

The Appellate Division, Second Department unanimously affirmed the lower Court’s decision granting summary judgment to GVK’s client, a paving contractor. Plaintiff-Appellant, a pedestrian, tripped and fell on a chain that was suspended approximately 4-5 inches above ground between two posts.

GVK successfully argued in the Supreme Court, Kings County that the paving contractor had no liability under the Espinal doctrine, as it was an independent contractor that did not launch a force of harm. It was argued that the paving contractor had no obligation to maintain the chain under its contract with the property owner and was not the entity that actually placed the chain. In addition, GVK argued that, since the accident during daylight and was readily observable by the reasonable use of one’s senses, the chain was open and obvious and not inherently dangerous.

The Appellate Division, Second Department adopted GVK’s arguments and, in particular, that the chain was not inherently dangerous and constituted an open and obvious condition. GVK’s client was also awarded a bill of costs for the appeal.

The decision was particularly important because the Appellate Division, Second Department typically denies similar motions on the grounds that whether a condition is open and obvious is a question for the jury. Possible reasons for this defendant-friendly decision in an otherwise plaintiff-leaning appellate court, include the clear and undisputed facts surrounding the accident and the interpretation that a chain is not inherently dangerous absent other factors, as well as the emerging trend of courts to dismiss cases when appropriate due to the backlog created by COVID-19.

He joins a select group of attorneys who are peer rated for the highest level of professional excellence.

He joins a select group of attorneys who are peer rated for the highest level of professional excellence.

Patrick is a trial attorney with over 29 years of experiencing trying catastrophic, high exposure and complex matters in State and Federal Court. He is well practiced in New York State Labor Law and the complex contractual and loss transfer issues associated with the NYS Labor Law.

Patrick has tried trucking/transportation, wrongful death, premises, slip/trip & fall, lead, false arrest/malicious prosecution, dram shop, sports/recreation, products liability, and municipal liability matters with great success.

View Patrick Cooney’s peer reviews at here.

While there is no date set for Civil jury trials to resume in New York, court administrators have been busy promulgating new rules which will substantially affect trial practice. As you will note, many of the new rules are adapted from Federal trial practice. Gone are the days when evidentiary rulings will be made with a witness on the stand and a jury in the box. Some of the key changes to the New York Uniformed Rules are discussed below.

1. Pursuant to Rule 202.34 all parties must consult with each other regarding proposed trial exhibits before the trial begins. The exhibits which the parties agree upon will be admissible and admitted into evidence before the trial begins. As a practical matter, counsel will be able to use agreed upon exhibits during openings if so desired.

2. Rule 202.34 also provides that the court must rule on any objections raised to exhibits “at the earliest possible time”. The rules indicate the court should make evidentiary rulings as early as the pre-trial conference.

3. Unless the court sets a different date, the parties must submit a pre-trial memoranda to the court of not more than 25 pages. See Rule 202.20-h[a].

4. Pursuant to Rule 202.20-h[b], on the first day of trial, the parties must submit a joint indexed binder or electronic document containing all the exhibits upon which the parties will rely. The presumption is that the court will have made all evidentiary rulings before trial, therefore the submitted binder will only contain admissible evidence.

5. Unless the court sets a different deadline, pursuant to Rule 202.20-h[c], the parties are submit charge requests and interrogatories on the first day of trial. It is axiomatic that the parties will need to know which exhibits will be admitted before preparing a charge request.

6. Unless the court states otherwise, Rule 202.37 will require each party to submit a written witness list at the start of trial. The list must identify all witnesses, when the witness will be called and estimate how long each witness will take. This rule does not apply to impeachment witnesses.

As of now, court administrators have not made any changes to the way jurors will be selected, however we should be prepared for changes to the selection procedures as well. Early evidentiary rulings may encourage additional settlement discussions and hopefully these changes will minimize the unpredictability at trial, something which most often hurts defendants. We will continue to keep you updated.

Following six years of contentious litigation, Jeannine Davanzo and Krystina Maola, obtain summary judgment in favor of GVK’s client, a healthcare products manufacturer, in a products liability and negligence lawsuit filed in Kings County, New York. The plaintiff alleged that he sustained injuries after he slipped and fell on water he claimed was emanating from the client’s ultrasonic cleaner during his employment at a hospital. The cleaner had undergone

routine preventative maintenance pursuant to a contract with the plaintiff’s employer approximately one month prior to the plaintiff’s alleged accident, which showed no water leaking or other issues.

The plaintiff testified that while performing his work, he would spill or drip water onto the floor. He also testified that the water that allegedly caused his accident could have originated from other cleaners and/or sinks in the room where he worked. Additionally, the plaintiff admitted that he had seen water on the floor on multiple occasions prior to his accident and would mop it himself and report it to his supervisor, neither of which he did on the date of his

accident.

GVK’s attorneys moved for summary judgment on several grounds, including that plaintiff could not establish the client’s product was defective in any way and that the client did not owe a duty to the plaintiff as a non-contracting third party, negating the required element for a negligence claim. In opposition, the plaintiff argued that the manufacturer of the cleaner owed a duty to him under the exceptions set forth in Espinal v. Melville Contrs., 90 N.Y.2d 136 (2002).

The court rejected the plaintiff’s argument, determining that there was no proof in the record to support the plaintiff’s products liability claim. The court also determined that the plaintiff’s negligence claim failed because the plaintiff did not allege any of the exceptions pursuant to Espinal that might give rise to a duty to plaintiff on the part of the manufacturer of the cleaner in his pleadings. The first time the plaintiff raised any of these arguments was in opposition to the motion for summary judgment. The court further agreed with defendant that since the

plaintiff did not plead the exceptions in his Complaint or Bill of Particulars as required, dismissal of the Complaint was appropriate. The case was dismissed in its entirety and plaintiff has not appealed.

The Honorable J. Curtis Joyner, in his decision dated January 8, 2021, in the case of Humans & Resources, LLC, d/b/a Cadence Restaurant vs. Firstline National Insurance Company, 20-CV-2152 (USDC, EDPA) denied the insurer’s motion to dismiss the policy holder’s declaratory judgment complaint which seeks damages for business interruption losses related to COVID-19 and the stay-at-home orders issued by the Governor of Pennsylvania and the Mayor of Philadelphia. The Court’s decision is seemingly overreaching as it ignored the plain unambiguous policy language to allow the policy holder to maintain a claim based on its assertion that it reasonably believed the policy would provide coverage for its losses.

In reaching its decision, the Court acknowledged that the subject “All Risk” policy required that the loss suffered by the business was caused as a result of some actual physical property damage or loss. The Court appreciated that the insured restaurant did not suffer any actual physical loss and that civil authority coverage was not triggered. Moreover, the subject policy contained a virus exclusion that excluded claims for losses resulting from viruses such as COVID-19. To reach its goal-oriented result, the Court applied Pennsylvania’s Doctrine of Reasonable Expectations and held that the policy holder’s “reasonable expectations” may have superseded the unambiguous policy language and exclusions.

“Under this doctrine, Pennsylvania courts have acknowledged the inherent disparity of bargaining power that exists between an insurer and insured, as well as the complexity of policy terms and conditions in insurance contracts,” and that “[t]his dynamic sometimes ‘forces the insurance consumer to rely upon the oral representations of the insurance agent’ which may or may not accurately reflect the contents of the written document.”

Although “in most cases, the language of the insurance policy will provide the best indication of the content of the parties’ reasonable expectations,” the courts must nevertheless “examine the ‘totality of the insurance transaction involved to ascertain the reasonable expectations of the insured.'”

Rational minds must question how a policy holder could have had a “reasonable” expectation that it purchased coverage for the claimed losses when the policy language expressly excluded coverage for those claims and where the Court concluded the policy language was not ambiguous and has been upheld in other cases.

The Court’s overreaching decision is disturbing. It was seemingly issued in contradiction with principles of both contract and insurance law. In fact, the Court, expressly stated in its decision that interpretation of contracts is generally an issue of law for the court. We note that the Court did not grant the policy holder summary judgment but merely denied the carrier’s motion to dismiss on the pleadings. Consequently, the Court allowed discovery to proceed. Insurers in Pennsylvania and throughout the country must hope that the case is either dismissed at trial or through appeals that will undoubtedly be filed.

GVK Partner, Joseph “Jay” Rava is excited to be speaking at the NYWBA Civil Courts and Litigation Committees and Jewish Lawyers Guild CLE Program

Maximizing Your Note of Issue Review

on Friday, January 22, 2021

1:00 pm – 2:10pm via Zoom

Other Speakers:

Hon. Lisa A. Sokoloff, Acting Supreme Court Justice, NY County

Bryce Mosse, Partner, Wingate Russotti Shapiro & Halperin

RSVP Required: CivilCourtsChairs@nywba.org

No Cost to Attendees

Materials, link and passcode to attend will be sent via email after receipt of RSVP. Questions please contact cle@nywba.org

1 professional practice credit to be issued by NYWBA

*CLE Credits: 1 professional practice credit. The New York Women’s Bar Association is an accredited CLE provider. Approval of CLE credit is pending in accordance with the requirements of the NYS CLE Board for the above-listed credit hours for established attorneys and as transitional credit hours for newly admitted attorneys.

The matter involves an underlying personal injury action, wherein the plaintiff sued our insurance carrier client’s insured for damages incurred as a result of a slip/trip and fall accident taking place on the insured’s property. When applying for coverage, the insured defendant elected first-party property damage coverage only. However, after being named a defendant in the underlying personal injury action, the insured defendant claimed he was entitled to general liability coverage under the subject policy and filed a declaratory action against our client seeking defense and indemnity of the plaintiff’s claim. Specifically, the insured defendant claimed he misinterpreted the coverage application form, and that his mistake was not a valid reason to disclaim coverage.

In our motion for summary judgment, we argued the insured never purchased commercial general liability coverage, and therefore, the carrier was not obligated to indemnify or defend the insured in the underlying action brought forth by the plaintiff. The motion was granted by The Honorable Keith Lynott, J.S.C. The Court agreed with our arguments and concluded the insured’s confusion or intent when filling out the insurance application and applying for insurance coverage is not relevant. Rather, the policy itself is the document that forms the contract/agreement between a carrier and its insured, and the policy herein is unambiguous. The Court held it is undisputed that the text of the policy does not provide coverage for general liability claims alleging bodily injury as a result of work or other activities conducted on or at the insured property. Consequently, our motion for summary judgment filed early and during the discovery period was granted, and all claims against the carrier have been dismissed with prejudice.